COVID-2019. The government's first economic measures

Reading time 10 m.

On March 02, 2020, the Decree Law No. 9/2020 on urgent support measures for families, workers and enterprises related to the epidemiological emergency of the COVID-19.

The measures concern, on the one hand, the shifting of tax deadlines and the facilitation of Smart Working, and on the other hand, the introduction of ad hoc social shock absorbers for both companies located in so-called red zones and those within the regions of Veneto, Emilia Romagna and Lombardy.

Here are the main measures.

Ordinary wage supplement treatment and ordinary allowance

Employers who intend to apply for ordinary wage supplementation (C.I.G.O.) or access to ordinary allowance (F.I.S.), For suspension or reduction of work activity, in production units located in municipalities identified by the DPCM 01.03.2020 (namely Bertonico, Casalpusterlengo, Castelgerundo, Castiglione D'Adda, Codogno, Fombio, Maleo, San Fiorano, Somaglia, Terranova dei Passerina, Vo'), as a result of the epidemiological emergency of the so-called "CoronaVirus", are exempted from compliance with theArticle 14 of Legislative Decree 148/2015 i.e., union information and consultation, and by compliance with the time limits of the proceedings stipulated in the Articles 15, paragraph 2, and by Article 30, paragraph 2, of the aforementioned legislative decree.

For the activation of the ordinary allowance, on the other hand, the employers themselves are exempt from the agreement requirement.

The same conditions as above apply to applications submitted by employers for production units Outside the municipalities of the so-called red zone, with reference to the Workers residing or domiciled in the aforementioned municipalities and therefore unable to work.

The application, in each case, must be submitted By the end of the fourth month following the month in which the period of suspension or reduction of work began, which in any case may not exceed three months.

Periods of ordinary wage supplementation treatment and ordinary allowance claimed for such reasons will not be counted toward the overall maximum duration provided for social shock absorbers. The same, however, are subject to an expenditure ceiling of 5.8 million for the year 2020.

The regular allowance will also be granted to workers employed by employers enrolled in the SIF who employ an average of more than 5 employees. An expenditure limit of 4.4 million for the year 2020 was also set for this benefit.

Finally, the decree specifies how the workers targeted by these measures must be employed by the employer as of Feb. 23, 2020.

Ordinary integration treatment for companies in CIGS

Companies located in the municipalities identified above, of the so-called red zone, which as of February 23, 2020, Have ongoing extraordinary wage supplementation treatment, may apply for the granting of ordinary wage supplementation treatment for a period in any case not exceeding three months (recognized in the maximum expenditure limit of 0.9 million euros for the year 2020), subject to the adoption by the Ministry of Labor and Social Policy of a decree to discontinue the effects of the aforementioned treatment.

The granting of ordinary wage supplementation treatment is subject to the discontinuation of the effects of the previously authorized granting of the extraordinary wage supplementation fund.

Waiver layoff fund for the so-called red zone

Private sector employers:

- With production units located of the red zone,

- or which do not have a registered office or production or operational unit in the above municipalities, limited to workers in force residing or domiciled in the above municipalities

- and for which The protections provided by the current provisions on suspension or reduction of working hours do not apply (e.g., they are not eligible for CIGO or Ordinary Allowance), they can apply for wage supplementation in derogation, for the duration of the suspension of employment and in any case for a maximum period of three months from the date of February 23, 2020.

This treatment also has a maximum expenditure limit of 7.3 million euros for the year 2020.

The layoff fund Is granted by decree of the regions concerned.

The allocation of the overall spending limit will be regulated by a directorial decree of the Ministry of Labor and Social Policy.

The regions, together with the granting decree, will send the list of beneficiaries to INPS, which will provide the aforementioned benefits. Applications will be evaluated in chronological order of submission.

Treatment can only be granted by direct payment mode of the benefit by INPS, so the employer is obliged to send to the Institute all the data necessary for the payment of the wage supplement, in the manner it determines, within six months from the end of the current pay period to the expiration of the term of the grant or from the date of the grant order if later.

Cassa integrazione in deroga for Lombardy, Veneto, Emilia-Romagna

Regions Lombardy, Veneto and Emilia-Romagna With reference to private sector employers,

- With production units located there (and not already included in the so-called red zone)

- or with production units outside the above-mentioned regions, limited to workers in force residing or domiciled in Lombardy, Veneto and Emilia Romagna

- and for which the protections provided by the current provisions on suspension or reduction of hours do not apply, may grant wage subsidies on an exceptional basis, for the duration of the suspension of employment and in any case for a maximum period of one month.

Such an exception fund may be granted limited to cases of established prejudice as a result of orders issued by the Ministry of Health and after agreement with the comparatively most representative labor organizations.

This treatment has a maximum expenditure limit, for the year 2020, of 135 million euros for the Lombardy region, 40 million euros for the Veneto region, and 25 million euros for the Emilia-Romagna region.

The workers are assured of imputed contributions and related fringe benefits. The treatment is granted only to workers in force as of February 23, 2020.

The cassa in deroga circumscribed here will be approved by decree of the regions concerned, to be transmitted electronically to INPS within forty-eight hours of adoption, the effectiveness of which is in any case subject to verification of compliance with spending limits.

The regions, together with the granting decree, will send the list of beneficiaries to INPS, which will provide the aforementioned benefits, after verifying compliance, including prospectively, with expenditure limits.

Applications will be evaluated in chronological order of submission.

The treatment Can only be granted under the mode of direct payment of the benefit by INPS, therefore, the employer is obliged to send to the Institute all the data necessary for the payment of the wage supplement, in accordance with the procedures established by the Institute, within six months from the end of the current pay period to the expiration of the term of the concession, or from the date of the concession order if later. After this deadline has expired unsuccessfully, payment of the benefit and related charges shall remain the responsibility of the defaulting employer.

Shifting tax deadlines

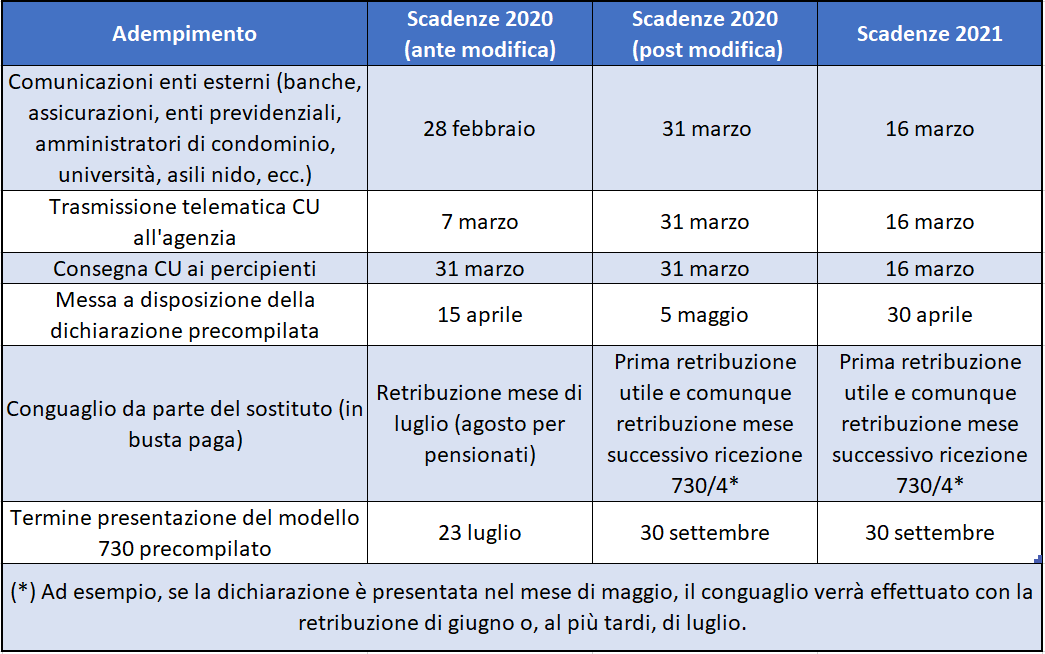

730 Pre-filed Declaration. Article 1 of Decree-Law 9/2020 shifted the effective date of what was initially planned for the year 2021 regarding the 730 form, bringing its application directly to 2020. In essence, the deadlines for the declaration are moved to September 30.

CU submission. The deadline for submission by substitutes of CUs is moved to March 31, 2020 and with it the deadline for the substitute to choose the person through whom dispositions are made.bili communications of the final result of the declarations.

CU delivery. The decree confirms the current deadline of March 31, 2020, by which tax withholding agents must deliver the unique certifications to those concerned.

Tax Assistance Operations. Provision is made to bring forward from 2021 to 2020 the effective date of the tax assistance deadline rescheduling provisions already contained in theArticle 16-bis of Decree-Law No. 124 of October 26, 2019..

In particular, rules will already be in effect from 2020 due to which the tax assistance adjustment by the substitute will take place with the "first useful pay and in any case on the pay accruing in the month following the month in which the substitute received the settlement statement".

Suspension of payment deadlines for loads entrusted to the collection agent

They are Deadlines arising from payment records suspended Issued by collection agents or charging notices for individuals or companies that had their residence or registered or operational headquarters In the municipalities of the red zone.

The suspension is meant for payments due from Feb. 21 to April 30, 2020, the same can be made in a lump sum by May 2020.

Suspension of deadlines for payment of social security and welfare contributions and compulsory insurance premiums

Article 5 provides how in the municipalities of the red zones, deadlines relating to the fulfilment and payment of social security and welfare contributions and compulsory insurance premiums are suspended (think, for example, of the deadline related to sending the wage declaration to INAIL) due during the period from February 23, 2020 to April 30, 2020.

Any amounts already paid will not be refunded, then as for the payment, this can be made from May 01, 2020, also by installments up to a maximum of 5 installments, without the application of penalties and interest.

Suspension of payments, withholdings, contributions and premiums for the tourist-hotel sector

The Decree stipulates that for the tourism-reception enterprises, travel and tourism agencies and tour operators Who have their tax domicile, registered office or place of business in Italy are Suspended from March 02 to April 30, 2020, the following fulfillments.:

- payments related to the withholding taxes referred to in theArticle 23 (On employment income), Article 24 (income assimilated to employment), Article 29 (income paid by the state) that enterprises operate as tax withholding agents;

- fulfillments and payments of the Social security and welfare contributions and compulsory insurance premiums;

Payments are made without penalty and interest in a lump sum by May 31, 2020.

Any contributions or premiums already paid are not refunded.

Are you left with doubts about the topic?

Join our free Live Talks!

Sign up for free through these links.