Mixed-use cars. New regulations effective July 1, 2020

La budget law no. 160 of 2019 modified theArticle 51, paragraph 4 (a) of Presidential Decree 917/1986 with reference to the tax and contribution discipline of cars granted to its employees for mixed use.

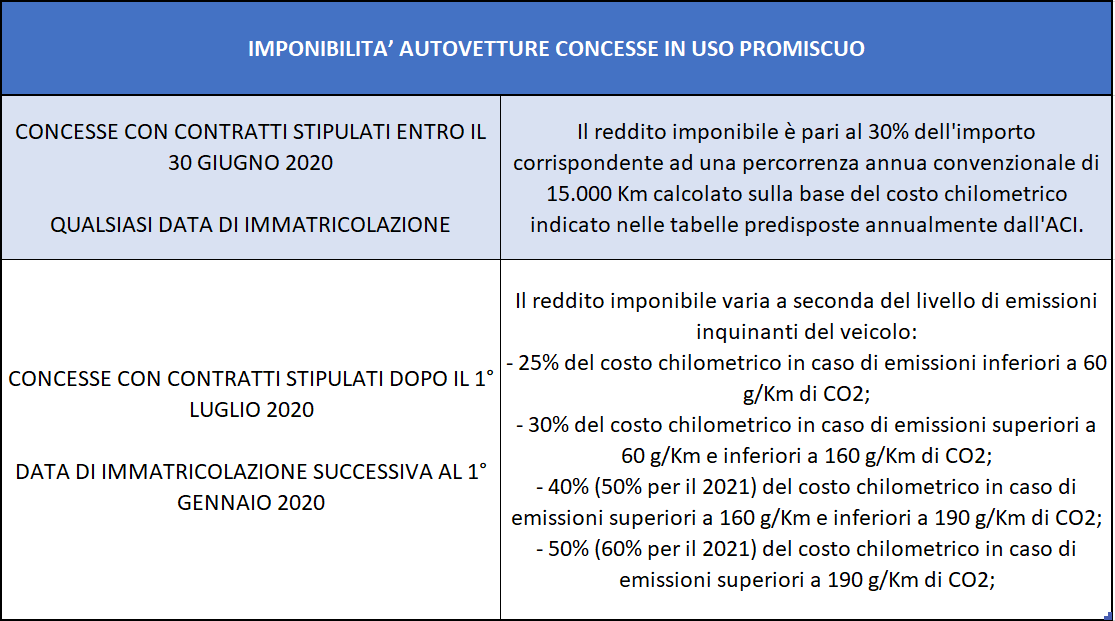

Specifically, the new ways of calculating taxable income referred to the fringe benefits of passenger cars, effective July 1, 2020, for newly registered vehicles (i.e. post January 1, 2020) and granted to employees in mixed use after July 1, 2020.

Also in the Budget Law 2020, the old regulatory framework is maintained without prejudice for cars granted until June 30, 2020, regardless of the date of registration of the vehicle.

Some doubt, on the other hand, about the management of cars granted after July 2020 but registered before January 1, 2020. In such a case, in the silence of the legislature, it would seem that the rules of the so-called normal value would apply.

In the following we will look at the different legislative disciplines and how fringe benefits are calculated.

Cars granted for mixed use until June 30, 2020

The amount thus calculated was assumed to be the annual "fringe benefit" on which the employee's tax liability and the company's and employee's contribution liability must be calculated.

According to the Law No. 160/2019, paragraph 633, this regulatory framework remains the same for vehicles granted for mixed use with contracts signed by June 30, 2020. The Budget Law makes no reference to the date of registration of the car.

The way fringe benefits are calculated will remain the same for as long as the car is granted, even after July 1, 2020, as the watershed date of granting the vehicle applies to determine the applicable in-kind pay calculation discipline.

Therefore, for a car registered after January 1, 2020 but granted by June 30, 2020, the calculation of remuneration in kind, taxable for tax and social security purposes, will follow the rules of the "old article" 51(4)(a).

An interesting question that could be asked is: but how do I prove the effective date of the company vehicle's grant?

One solution could be to send by PEC the signed concession contract in order to attest the document's certain date and prove it in case of audits.

Cars registered post-January 1, 2020 and granted mixed use post-July 1, 2020

- the 25% of the amount corresponding to a conventional mileage of 15,000 kilometers Calculated on the basis of the mileage cost of operation inferable from the annual national tables of ACI - If the vehicle has carbon dioxide emission values not exceeding 60 grams per kilometer (g/km CO2);

- the 30% of the amount corresponding to a conventional mileage of 15,000 kilometers Calculated on the basis of the mileage cost of operation inferable from the annual national tables of ACI - If the vehicle has carbon dioxide emission values above 60 g/km but not 160 g/km;

- 40% - for the year 2020 - and 50% - from the year 2021 - of the amount corresponding to a conventional mileage of 15,000 kilometers Calculated on the basis of the mileage cost of operation inferable from the annual national tables of ACI - If the vehicle has carbon dioxide emission values above 160 g/km but not 190 g/km;

- 50% - for the year 2020 - and 60% - from the year 2021 - of the amount corresponding to a conventional mileage of 15,000 kilometers Calculated on the basis of the mileage cost of operation inferable from the annual national tables of ACI - If the vehicle has carbon dioxide emission values above 190 g/km.

The intent of the legislature is clearly to facilitate the purchase and concession of electric or low CO2 per g/km vehicles as they result in a lower tax burden for companies and a lower tax impact for employees, and to penalize the most polluting vehicles.

On Dec. 31, 2019, the new national tables of mileage costs of operating cars and motorcycles prepared by ACI were published in the Official Gazette by the Internal Revenue Service.The tables present 4 different columns, for each individual model of passenger car, indicating the annual fringe taxable amount to be taken as a reference in consideration of the vehicle's emissions. The tables do not make explicit, for each model, the level of emissions; this data must be retrieved from the documents related to the passenger car.

Cars registered before January 1, 2020, and granted mixed use after July 1, 2020

A scenario that will not infrequently happen in the company. Consider the replacement of an outgoing worker, who is given the car previously granted to the colleague, or the acquisition of a used car, which is granted to the new employee.

If the car was registered before Jan. 1, 2020, given its grant after July 1, 2020, the tax and contribution discipline of the car would not fall under any of the above-mentioned cases.

So, in the event that the employer decides to grant its car purchased on January 1, 2018 to a new employee hired on July 13, 2020 what calculation method should it apply to value the fringe benefit?

In our opinion, the lack of specific regulations for this particular case means that, for the purpose of valuing remuneration in kind for the calculation of social security contributions and withholding taxes, the normal value of the asset granted for mixed use must be taken as a reference.

A solution that would result in increased charges on the employer, since the normal value would refer to "the average price charged for goods and services of the same or similar kind, under conditions of free competition and at the same stage of marketing." Ergo, the car would be valued at the rental or lease cost, including all related charges.

We confidently await clarification from the Internal Revenue Service on this issue.